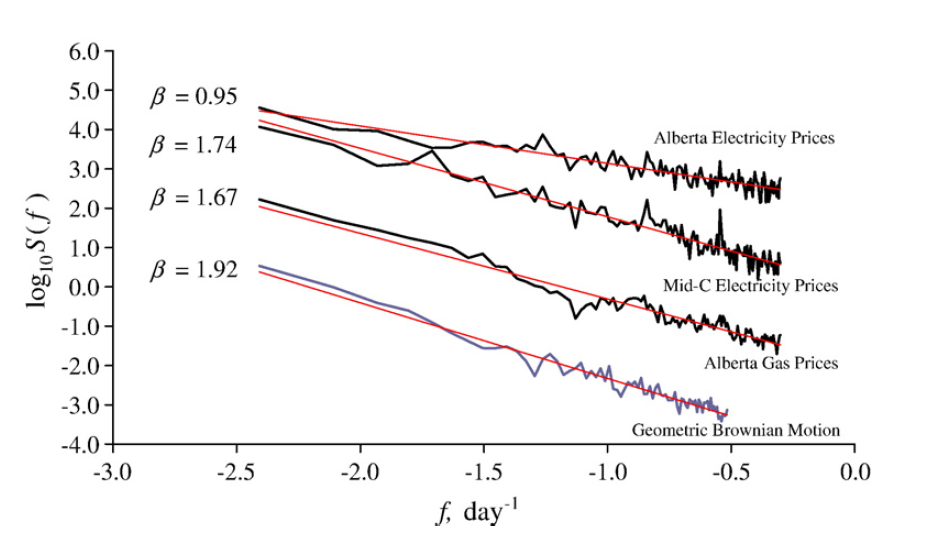

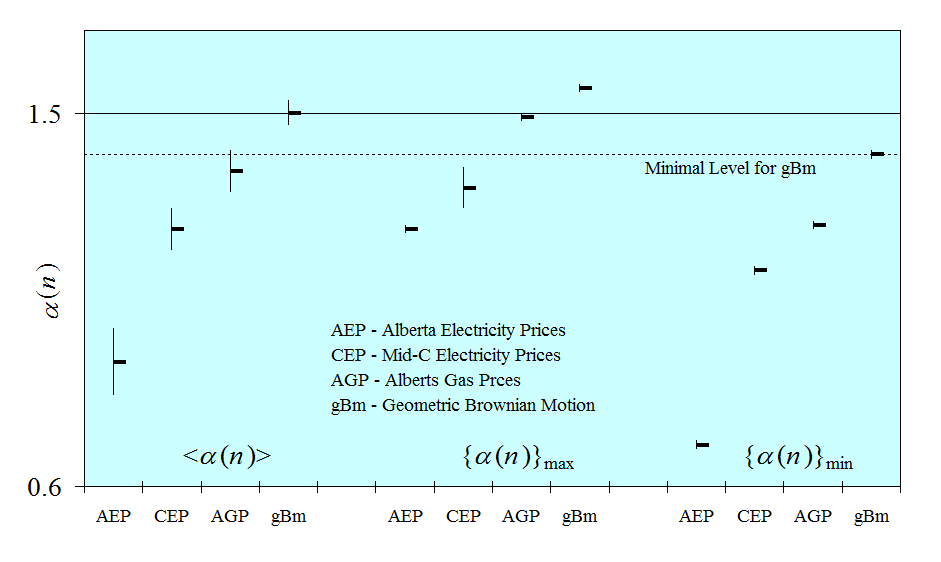

One of the basic features of efficient markets is the absence of correlations between price increments leading to random walk-type behavior of prices. In this paper, we propose a new approach for measuring deviations from the efficient market state based on an analysis of scale-dependent fractal exponent characterizing correlations at different time scales. The approach is applied to two electricity markets, Alberta and Mid Columbia (Mid-C), as well as to the AECO Alberta natural gas market (for purposes of providing a comparison between storable and non-storable commodities). We show that price fluctuations in all studied markets are not efficient, with electricity prices exhibiting multiscale correlated behavior which is significantly different from the monofractal model.

Uritskaya O.Y., Serletis А. Quantifying Multiscale Inefficiency in Electricity Markets // Energy Economics, Vol. 30, Issue 6, November 2008, p. 3109-3117

Fig 1. Power spectra of electricity and natural gas prices.

Fig 2. Average and Extreme Values of DFA Exponents.