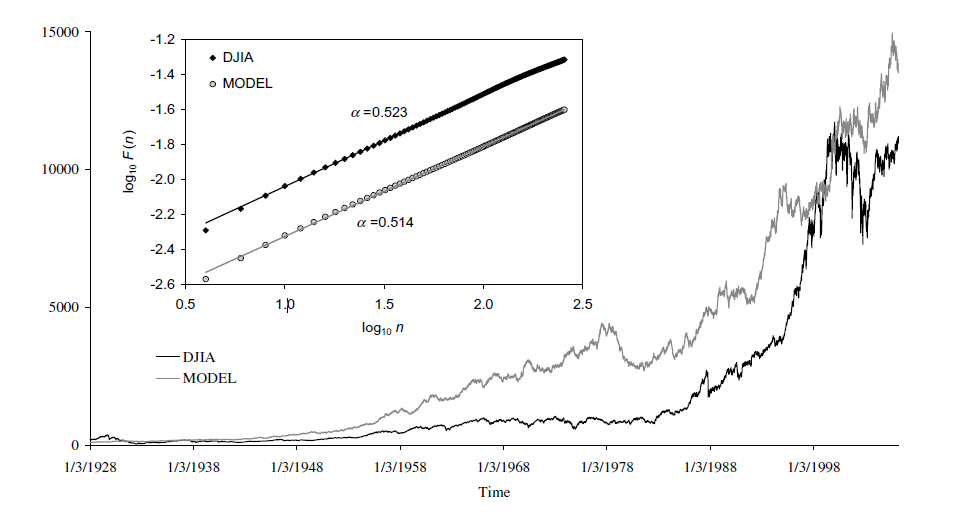

Based on the detrended fluctuation analysis of the Dow Jones Industrial Average (DJIA) index, we demonstrate that the U.S. stock market operates close to the state predicted by the efficient market hypothesis. The observed transient deviations from this state are shown to have a statistical origin as they also appear in purely random geometric Brownian motion models of the DJIA dynamics.

Serletis А., Uritskaya O.Y., & Uritsky V.М. Detrended Fluctuation Analysis of the US Stock Market // International Journal of Bifurcation and Chaos, Vol. 18 (2), 2008 – p. 599-603.

Fig. 1. The comparative dynamics of the Dow Jones industrial average and a simulated geometric Brownian motion time series. Inset: DFA functions of both signals in the range 4–256 days.