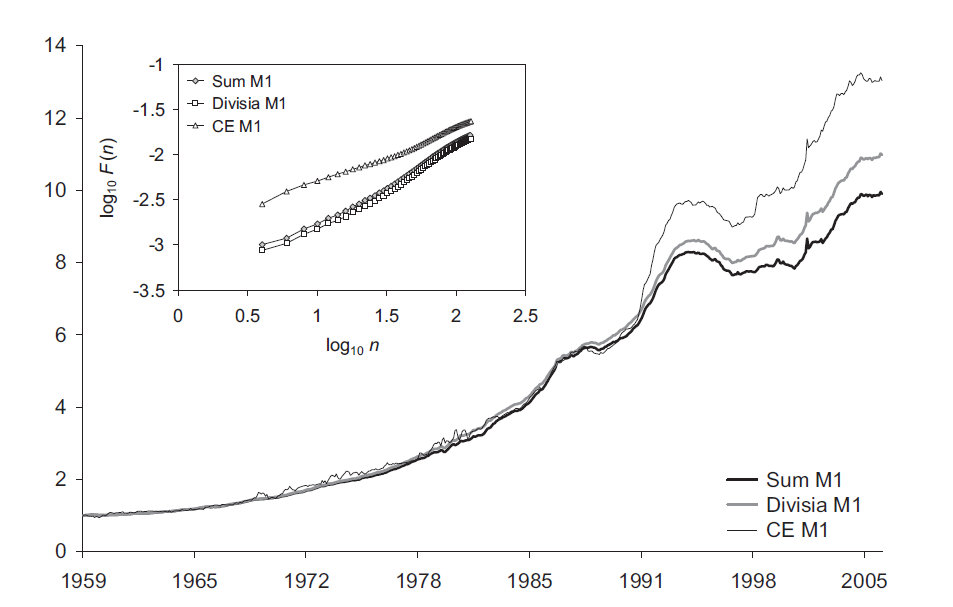

In this study, we continued the research by Serletis and Shintani by applying the method of detrended fluctuation analysis (DFA) introduced by Peng and adapted to the analysis of long-range correlations in economic data by Uritskaya to investigate the dynamical structure of United States money and velocity measures. We used monthly data over the time period from 1959:1 to 2006:2, at each of the four levels of monetary aggregation, M1, M2, M3, and MZM, making comparisons among simple-sum, Divisia, and currency equivalent methods of aggregation. The results suggest that the sum and Divisia monetary aggregates are more appropriate for measuring long-term tendencies in money supply dynamics while the currency equivalent aggregates are more sensitive measures of short-term processes in the economy.

Serletis А., Uritskaya O.Y. Detecting Signatures of Stochastic Self-Organization in US Money and Velocity Measures // Physica A, Vol.385 (1), 2007. – p. 281-291.

Fig. 1. Time series and DFA plots for sum, Divisia, and CE money measures at M1 level of monetary aggregation.