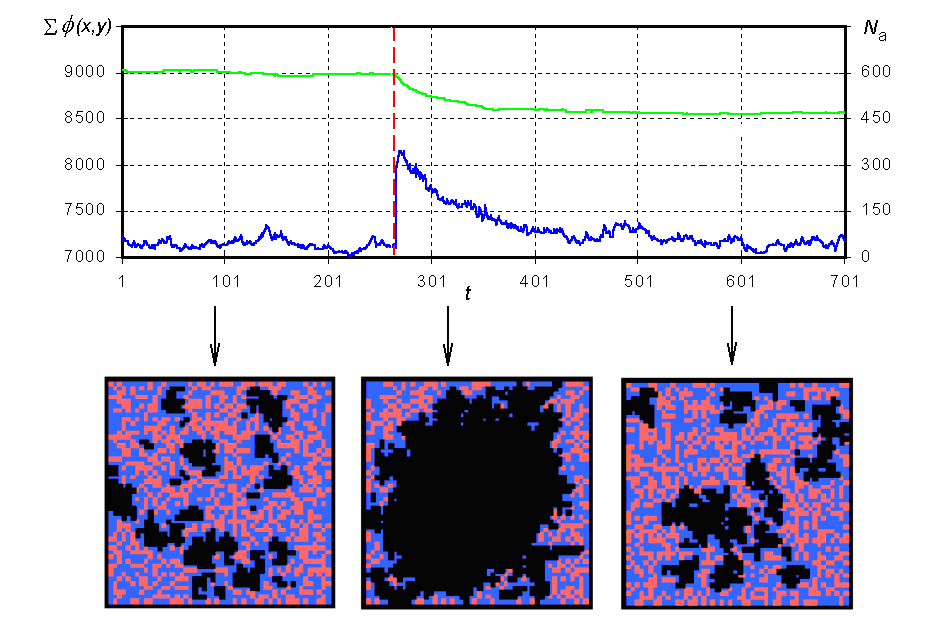

A new approach to an investigation and modeling of dynamical systems in the economics is considered. Using a cellular automaton model, we show that stock markets, as complex systems with many coupled degrees of freedom, can operate in a stationary critical state associated with the regime of self-organized criticality (SOC). It is suggested that SOC condition is the optimal regime of functional activity of open economic systems. Simulation results indicate that dynamical economical systems considered as SOC systems can be quantified based on fractal analysis of low-frequency fluctuations of appropriate parameters.

O.Y.Uritskaya, A.V.Fedotov. On the Application of Self-Organized Criticality Concept to Complex Economic Systems Modeling // Annals of St.Petersburg Technical University, St.Petersburg: SPbSTU Press, 1998, p.230-239.

Fig. 1. Disturbance and restore stability in the cell self-organized criticality model with variable threshold of elements interaction.