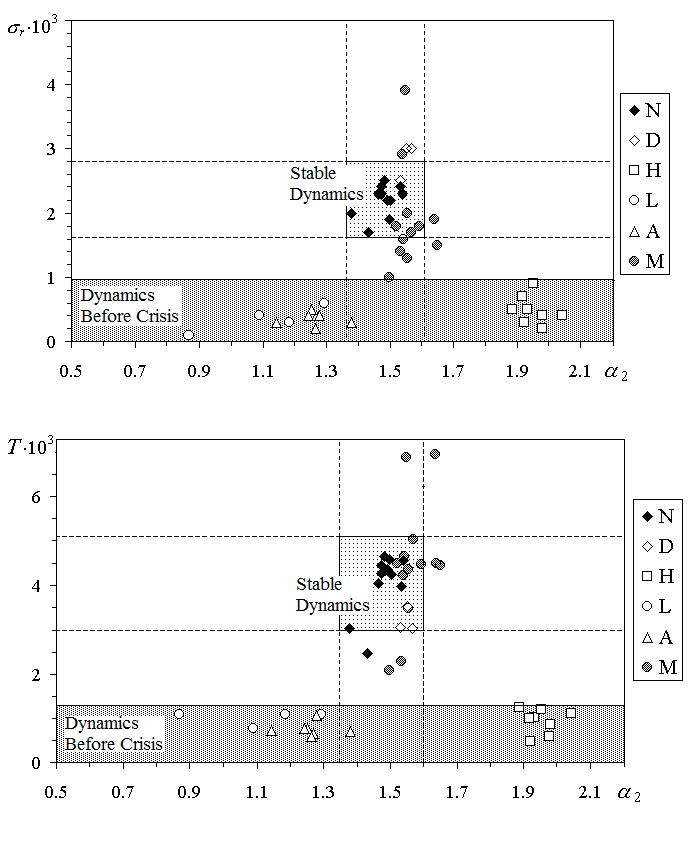

The results of theoretical research of conditions of stability in macroeconomic systems have been presented. Based on review of resent publications it has been shown that the macroeconomic systems are complex interactive systems and their crisis dynamic can be investigated with using of fractal analysis methods. The most stable dynamic state of the macroeconomic complex system is condition of self-organizing criticality, which characterized by fractal structure of corresponded time series with dimension 1.5 indicated effective market theory. Economic and financial crises are related to sub- and supercritical regimes of system’s dynamic, which can be revealed by deviations of fluctuations intensity and fractal parameters beyond the normal limits well before crises start.

O. Y. Uritskaya. Stability of the Open Macroeconomic Systems // Management in the Social and Economic Systems. // St. Petersburg: SPbSTU Press, 2006, p. 304-326.

Fig. 1. Stability diagram of the dynamics of national currencies: the intensity σr of and statistical temperature T of currency fluctuations as a function of the fractal index a2 . The dashed lines correspond to the levels of deviation parameters N group for the value of three standard deviations (±3s) from the mean values. N – Economically developed countries: Great Britain, Greece, EU, Canada, New Zealand, Norway, USA, Swiss, Japan, Australia; D – Developing countries with relatively stable monetary systems: Israel, Columbia, Chili, South Africa; H and L – Unstable Developing countries, prior to crises: Bulgaria, Brazil, India, Kazakhstan, Mexico, Russia, Rumania, Turkey, Ecuador; А – Unstable Developing Asian countries before the 1997 monetary crisis: Indonesia, Malaysia, Singapore, Thailand, Taiwan, Philippines, South Korea; М – Marginally stable, Countries from groups Н, L and А after crises.