A new lecture textbook for МА specializing in economics, mathematical and quantitative methods, macroeconomics and monetary economics. Basic forms of economic system stability and new quantitative methods and approaches to its are considered. Main attention is paid to issues of amount and sufficiency of information in the system. Novel approaches to forecasting and simulations of complex economic systems dynamics and their application examples are presented.

O. Y. Uritskaya. Stability and Risk Evaluation in Economic systems // St. Petersburg: SPbGTU Press, 2005, 171 p.

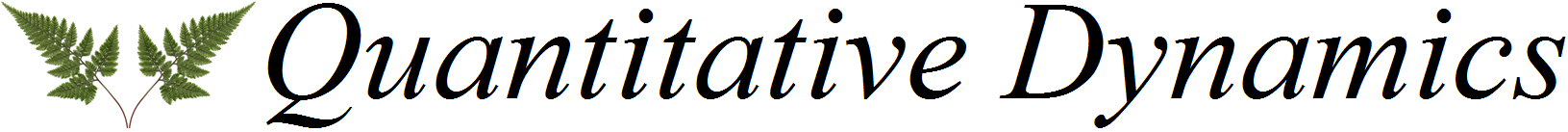

Fig. 1. Examples of fluctuations in daily average exchange rates in the economic systems with different levels of stability: Russian ruble, Brazilean real, Indonesian rupia and European Currency unit.

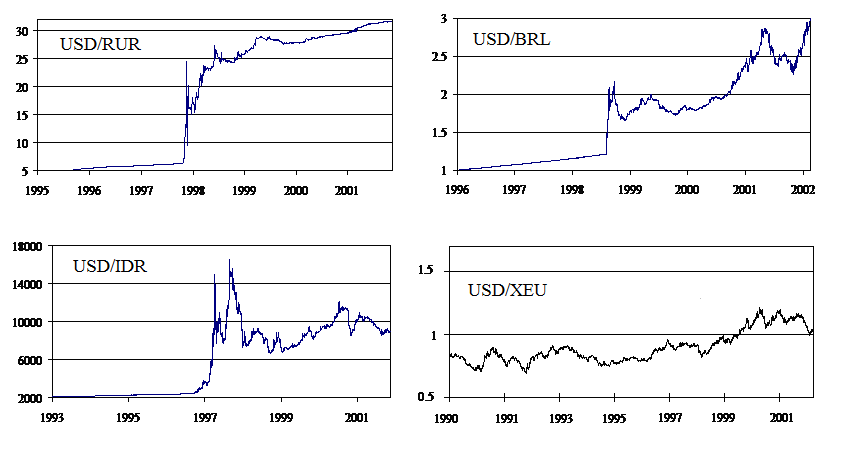

Fig. 2. Classification of currency exchange rate fluctuations based on the estimation of DFA exponents 1 (4–30 days) and 2 (30–90 days). According to the efficient market hypothesis, the point 1 = 2 =1.5 corresponds to the optimal state of the national currency system with maximum long-term stability of the exchange rate. The countries were grouped according to the values of parameters: N – Economically developed countries: Great Britain, Greece, EU, Canada, New Zealand, Norway, USA, Swiss, Japan, Australia; D – Developing countries with relatively stable monetary systems: Israel, Columbia, Chili, South Africa; H and L – Unstable Developing countries, prior to crises: Bulgaria, Brazil, India, Kazakhstan, Mexico, Russia, Rumania, Turkey, Ecuador; А – Unstable Developing Asian countries before the 1997 monetary crisis: Indonesia, Malaysia, Singapore, Thailand, Taiwan, Philippines, South Korea; М – Marginally stable, Countries from groups Н, L and А after crises.

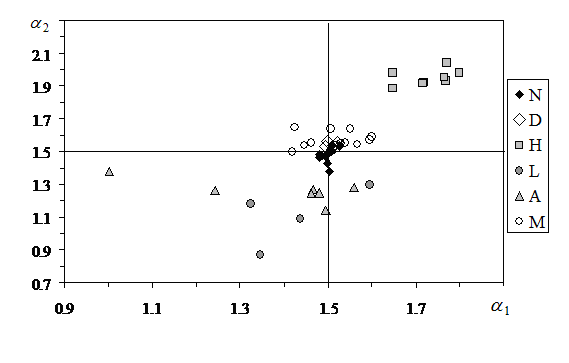

Fig. 3. An example of a time series from the group N (US dollar against the German mark), showing variations in the fractal indices 1 and 2 in the range of 1.25 to 1.75. Index 2 does not cross these critical levels for 30 years.

Contents

Lecture 1. Economic Risk and Economic Information.

The reasons for appearance of risks in economics. Difficulties of scientific research in economics. Content and classification of economic information.

Lecture 2. Characteristics of the Economic Systems.

System essence of economic objects. Main system principles. The large interactive systems. System analysis.

Lecture 3. Stability of an Economic System.

Stability of an economic system; critical conditions and crises. Forms of economic system stability. The history of investigation of the equilibrium in economics. Self-organized nature of dynamical equilibrium.

Lecture 4. Mathematical Modeling of Economic Systems.

“Mathemazation” in science. Deterministic and stochastic models. Problems of complex system modeling. History of mathematical modeling in economics. Holistic approach to simulations.

Lecture 5. Preparing and Processing Economic Data

The problem of selecting economic system state variables. Direct economic observations. Economic time series. Requirement to economic time series. Fluctuations of economic indices.

Lecture 6. Time Series Analysis

History of time series analysis. Generated, deterministic and stochastic time series. Fluctuations and bifurcations in time series. Problem of management in the complex economic system.

Lecture 7. The Theory of Self-Organized Criticality.

Mechanisms of catastrophes in complex systems. Reasons of local instability and global stability of the complex system. Physical model. Fractal structure of time series produced by complex interactive systems.

Lecture 8. Fractals and Their Properties.

Fractional dimension. Scale invariance. Self-similarity. Geometric fractals. P.Bak’s theorem of complex equilibrium.

Lecture 9. Methods of Fractal Time Series Analysis.

Estimation of the fractal dimension of time series. Geometric and statistical methods of fractal dimension estimation and their comparative characterization.

Lecture 10. Forecasting Fractal Dynamics.

Modeling of stochastic processes. Efficient market hypothesis. Forecasting time series behavior. Interpretation of fractal analysis results. Persistent and anti-persistent behavior of economic processes. Using fractal analysis for system stability evaluation. Sub- and super-critical conditions of unstable complex system evolution.

Lecture 11. The Risk Factors in the Macroeconomic Systems.

The world facilities as a system. The world trade, the international migration of the production’s factors. International exchange and financial relations. The international economic integration.

Lecture 12. The World Currency System. The Exchange Rates.

The international exchange system and its evolution. Nominal and real exchange rates. Floating and fixed exchange rates. The devaluation and revaluation. The international exchange market.

Lecture 13. The Macroeconomic System’s Classification by the Level of Dynamical Stability.

Fractal analysis of currency time series. Classification of the currencies by the stability groups. Recovering of system stability after the economic crisis.

Lecture 14. Evaluating Economic System Stability.

Methodology of evaluation of exchange rate volatility by logarithmic returns. Comparison of volatility values of stable and unstable floating exchange rates. Optimal intensity of exchange rate fluctuations

Lecture 15. Modeling Characteristics of Active Phase of Economic Crisis.

Determination of normal range of nonstationary fluctuations of Peng’s critical exponent. Evaluating time series fractal structure Evaluation of accumulated deviation of Peng’s exponent beyond the normal range and its relation to crisis magnitude and duration. Fractal regression of monetary crashes.

Lecture 16. Estimating Risks by Statistical Methods.

Standard probabilistic and statistical methods for risk estimation and their inherent limitations. Risk Levels. Risk Factors. Risk Scales.

Lecture 17. Estimating Economic Risks by Fractal Methods.

Quantitative risk assessment by fractal methods. Pareto exponent and its economic interpretation. Examples of financial risk estimation by the Pareto exponent technique.

Lecture 18. The Methods of Economic Risk Reduction.

The main methods of reduction of the risk in economic systems. Insurance, standby, limiting, diversification and hedging as instruments of the reduction of the economic risk.

Problems

Problem 1. Estimation of the fractal dimension of time series by ruler method. Forecast and risk evaluation.

Problem 2. Quantitative risk assessment by fractal method. Insurance risk evaluation.

Training session. Computer game “Stock market tactics”: description and trading examples.